Welcome to Celebra, where we unravel the mysteries of finance one concept at a time! In this comprehensive guide, we delve into the intriguing world of Target Net Income. Whether you’re a seasoned entrepreneur or a budding business enthusiast, understanding and optimizing your Target Net Income is crucial for financial success. So grab your calculators and get ready to embark on a journey of calculation, optimization, and real-world case studies. Let’s uncover the secrets of Target Net Income together!

For you, Mastering Profitability: The Ultimate Guide to Target Net Income Calculator for Business Success

Key Takeaways

- The target net income formula is calculated by subtracting all variable costs and fixed costs from total sales.

- To calculate the target net income, multiply the expected number of units to be sold by their expected contribution margin and subtract the total expected fixed costs.

- The basic formula used to compute the target net income involves subtracting the desired profit margin from the target selling price.

- Target net income represents the revenue earned from the main business activity and is derived from the formula: Net Income = Total Revenues – Total Expenses.

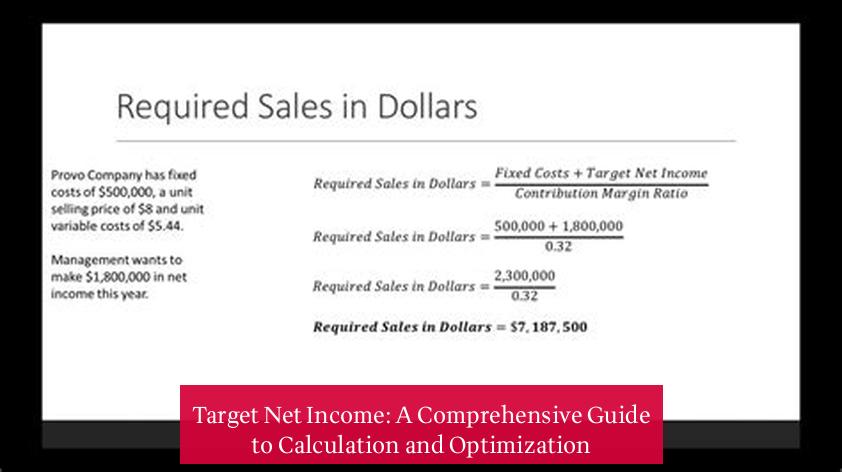

- Projected sales can be calculated using the formula: Projected sales = (target profit + fixed costs) / contribution margin per unit.

- To achieve a target net income, the required sales in units can be determined by dividing the total dollars needed in sales by the unit price.

Target Net Income: A Comprehensive Guide to Calculation and Optimization

Understanding the Concept of Target Net Income

Target net income, also known as target profit, represents the desired amount of profit a company aims to achieve within a specific period, typically a quarter or a year. It serves as a financial benchmark against which the company’s actual performance is measured. By setting a target net income, businesses can establish clear financial goals, align their operations with revenue targets, and make informed decisions to optimize profitability.

Calculating target net income involves subtracting all variable and fixed costs from total sales. This formula provides a comprehensive understanding of the company’s revenue streams and cost structure, enabling managers to identify areas for improvement and cost optimization.

Calculating Target Net Income: Step-by-Step Guide

To calculate target net income, businesses can follow these steps:

-

Determine Total Sales: Estimate the total revenue expected to be generated from product or service sales during the target period.

-

Identify Variable Costs: These costs fluctuate with production or sales volume, such as raw materials, direct labor, and commissions.

-

Estimate Fixed Costs: Unlike variable costs, fixed costs remain constant regardless of production or sales levels, including rent, salaries, and insurance premiums.

-

Calculate Contribution Margin: Subtract variable costs from total sales to determine the contribution margin, which represents the portion of sales revenue that contributes to covering fixed costs and generating profit.

More related > Jon and Kate Plus 8 Net Worth: Unveiling the Financial Journey of the Gosselins

-

Subtract Fixed Costs: Deduct total fixed costs from the contribution margin to arrive at the target net income.

Optimizing Target Net Income: Strategies and Considerations

Achieving target net income requires a strategic approach and ongoing monitoring of financial performance. Here are some strategies to optimize target net income:

-

Increase Sales Volume: Boosting sales volume through effective marketing campaigns, product development, and customer service can increase total sales and, consequently, target net income.

-

Control Variable Costs: Implementing cost-saving measures, negotiating with suppliers, and optimizing production processes can reduce variable costs, leading to higher contribution margins.

-

Minimize Fixed Costs: Businesses can explore cost-cutting strategies for fixed expenses, such as negotiating lower rent, outsourcing non-core functions, and automating processes.

-

Monitor Performance: Regularly tracking actual net income against the target net income allows businesses to identify performance gaps and make timely adjustments to optimize profitability.

-

Set Realistic Targets: Setting achievable target net income is crucial. Overly ambitious targets can lead to unrealistic expectations and hinder financial planning.

Case Study: Target Net Income in Practice

Consider a company with the following financial data:

- Total Sales: $1,000,000

- Variable Costs: $500,000

- Fixed Costs: $200,000

Step 1: Calculate Contribution Margin

Contribution Margin = Total Sales – Variable Costs

Contribution Margin = $1,000,000 – $500,000

Contribution Margin = $500,000

Step 2: Calculate Target Net Income

Target Net Income = Contribution Margin – Fixed Costs

Target Net Income = $500,000 – $200,000

Target Net Income = $300,000

In this case, the company’s target net income is $300,000. To achieve this target, the company can implement strategies to increase sales volume, control variable costs, and minimize fixed costs. Regular monitoring of financial performance will ensure that the company stays on track towards achieving its target net income.

How do you calculate target net income?

Answer: To calculate the target net income, multiply the expected number of units to be sold by their expected contribution margin and subtract the total expected fixed costs. The formula is derived by subtracting all variable costs and fixed costs from total sales.

What is target net income?

Answer: Target net income represents the revenue earned from the main business activity and is derived from the formula: Net Income = Total Revenues – Total Expenses.

What is the basic formula used to compute the target net income?

Answer: The basic formula used to compute the target net income involves subtracting the desired profit margin from the target selling price. For example, if a company has a target selling price of $200 and the desired profit margin of $40, the company’s target cost would be $160.

What is the target formula?

Answer: The target formula involves subtracting all variable costs and fixed costs from total sales. It can also be calculated by subtracting the desired profit margin from the target selling price.

How is projected sales calculated?

Answer: Projected sales can be calculated using the formula: Projected sales = (target profit + fixed costs) / contribution margin per unit.