Have you ever wondered what your net worth should be by the time you hit 30? It’s a common question that often leads to feelings of confusion and uncertainty. But fear not! In this comprehensive guide, we’ll delve into the world of net worth targets, financial milestones, and savvy investment strategies to help you pave the way towards achieving your target net worth by 30. So, grab a cup of coffee and get ready to embark on a journey to financial success!

Key Takeaways:

- Having a net worth target of $1 million at age 30 is a good goal, but most people at age 30 have a net worth of $2 million, so it’s important to aim higher.

- Your net worth should at least grow at the rate of inflation each year to avoid getting poorer in real terms.

- For a solid financial future, it’s important to set net worth targets by age and take action to achieve them, such as maxing out 401k and IRA contributions and saving an additional 20% or more after taxes.

- The average net worth for people between the ages of 35 and 44 is $436,200, with a recommended savings target of at least three times your income by age 40.

- Target Corporation’s net worth as of February 06, 2024, is $65.71B, and it has experienced significant growth in recent years.

- It’s important to understand the average net worth targets by age, income, or work experience to gauge where you stand financially and plan for the future.

Understanding Net Worth Targets by Age

Setting net worth targets by age is a strategic approach to ensure financial stability and growth over time. It is essential for individuals to gauge their financial progress against measurable goals. The concept of having a net worth target by 30 is a benchmark for many aspiring to secure a solid financial future.

The Importance of Setting Goals

Setting a net worth target serves as a financial compass. It provides direction and purpose to financial planning, much like a navigational tool that helps individuals chart their course towards financial independence. With clear objectives, it’s easier to allocate resources effectively, make informed investment decisions, and prepare for unforeseen economic fluctuations.

Net Worth Projections and Reality

While aspiring for a net worth of $1 million by age 30 is commendable, it is vital to recognize that the bar has been raised. With the average net worth for 30-year-olds reportedly at $2 million, the target for the ambitious should be adjusted accordingly. This gap between aspiration and reality can be the driving force for more aggressive saving and investment strategies.

Growth at the Rate of Inflation

To prevent the erosion of purchasing power, it is crucial that one’s net worth grows at least at the rate of inflation annually. If the net worth stagnates or grows at a slower pace than inflation, the individual is effectively losing wealth over time.

Net Worth Milestones by Decade

Each decade of an individual’s life presents unique financial challenges and opportunities, and it’s prudent to have net worth milestones tailored to these stages.

Read : Future Net Worth Forbes: Exploring the Billionaires’ Landscape and Celebrity Wealth

Net Worth at Age 30

By age 30, setting a substantial net worth target is fundamental. As per the guidelines from Financial Samurai, if most peers have accumulated a net worth of $2 million, setting a similar or higher goal is advisable. This could involve maxing out retirement accounts like 401k and IRA contributions, and saving an additional 20% or more of after-tax income.

Net Worth at Age 40

As individuals move into their 30s and 40s, net worth targets should evolve to reflect career growth, family responsibilities, and the approaching horizon of retirement. By the age of 40, aiming for a net worth that is at least three times your annual income is recommended. For instance, with an annual income of $80,000, a net worth of $240,000 would be a prudent target.

Saving and Investment Strategies for Growth

Building a considerable net worth by 30 requires disciplined saving and astute investment strategies. Here are some actionable tips to help achieve these financial goals:

Maximize Retirement Contributions

One of the most effective ways to grow net worth is to fully utilize retirement accounts. Maxing out 401k and IRA contributions annually can significantly impact one’s net worth due to the power of compound interest and tax advantages.

Save Beyond Retirement Accounts

While retirement accounts are critical, they should not be the sole focus. Saving an additional 20% or more of after-tax income can provide a buffer for investments, emergencies, or other financial goals.

Diversify Investments

Diversification across various asset classes can reduce risk and improve the potential for growth. Taking calculated risks in investments, such as in stocks, bonds, real estate, or even entrepreneurial ventures, can lead to significant gains.

Gauging Financial Progress

Understanding where one stands financially in comparison to peers can offer insight into the effectiveness of one’s financial strategies. Tools and benchmarks, such as the average net worth by age, are invaluable for this purpose.

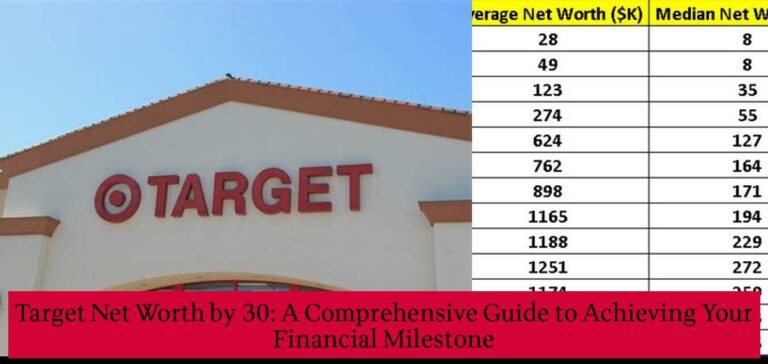

Median and Percentile Benchmarks

Looking at the mean, median, and percentile data for net worth can provide a more nuanced understanding of financial standing. It is important to digest and comprehend the 25th, 50th, and 75th percentile data to grasp how one’s net worth compares to others in the same age bracket.

The Corporate Example: Target’s Net Worth Growth

Examining the financial growth of corporations such as Target Corporation, with a net worth of $65.71B as of February 2024, can offer insights into effective growth strategies. Target’s consistent growth, driven by factors like customer traffic and sales performance, can serve as an inspiration for personal financial growth strategies.

Lessons from Target’s Financial Strategy

Target’s growth over recent years has been a result of strategic planning and execution. Individuals can learn from such corporate strategies by understanding the importance of consistent investment, adapting to market changes, and focusing on long-term goals.

Final Thoughts on Achieving Your Target Net Worth by 30

Achieving a target net worth by 30 requires a combination of ambitious goal-setting, disciplined financial practices, and strategic investment decisions. By understanding the benchmarks and strategies for growth at each stage of life, individuals can navigate their financial journeys with confidence and clarity.

Remember, while the journey to financial independence is personal and unique, the principles of saving diligently, investing wisely, and setting realistic yet challenging targets are universally applicable. With these in mind, the goal of reaching a net worth of $1 million or more by the age of 30 is not just a dream but a feasible objective.

What is the recommended net worth target by age 30?

The recommended net worth target by age 30 is at least $1 million, but most people at this age have a net worth of $2 million, so it’s advisable to aim higher.

How much should your net worth grow each year to avoid getting poorer in real terms?

Your net worth should at least grow at the rate of inflation each year to avoid getting poorer in real terms.

What is the average net worth for people between the ages of 35 and 44?

The average net worth for people between the ages of 35 and 44 is $436,200.

What is the recommended savings target by age 40?

The recommended savings target by age 40 is at least three times your income.

What is Target Corporation’s net worth as of February 06, 2024?

Target Corporation’s net worth as of February 06, 2024, is $65.71 billion, and it has experienced significant growth in recent years.