Uncover the fascinating world of wealth management and investment prowess with our deep dive into the business acumen of Chris Hansen, the mastermind behind Valiant Capital Management. From the Sonics Arena Investment Group to his impact on Seattle’s economic landscape, get ready to explore the strategies, challenges, and triumphs that have shaped Hansen’s remarkable legacy. Join us as we unravel the secrets behind his success and the economic ripple effect of his ventures. Let’s dive in and discover the captivating story of Chris Hansen’s financial empire!

Key Takeaways:

- Chris Hansen is an American hedge fund manager who founded Valiant Capital Management in 2008.

- Valiant Capital Management, the hedge fund founded by Chris Hansen, had $2.7 billion in assets in 2012.

- Chris Hansen’s personal wealth is private, but it is known that he is worth more than $300 million.

- Chris Hansen is part of the Sonics Arena Investment Group, aiming to bring NBA basketball back to Seattle.

- Hansen’s hedge fund, Valiant Capital Management, is estimated to have around $2.8 billion in assets under management.

- Chris Hansen has made significant investments, including around $60 million into land for building a new basketball/hockey arena in SoDo.

Understanding the Business Acumen of Chris Hansen

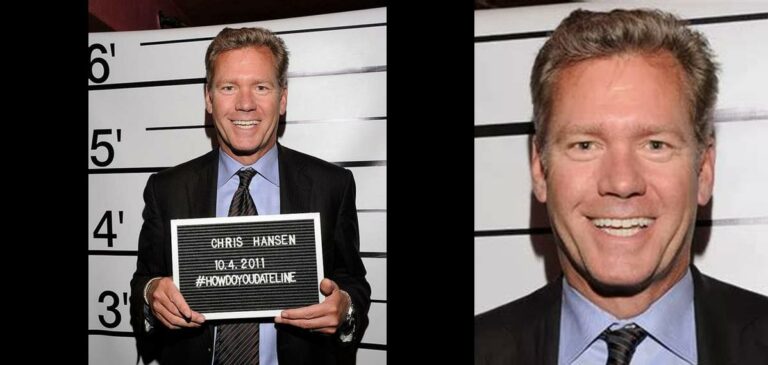

Chris Hansen is a name that resonates with ambition and financial acumen within the bustling city of Seattle. With a career that spans the complexities of hedge funds and the passionate pursuit of reviving Seattle’s cherished basketball heritage, Hansen has established himself as a notable figure in the world of investment and sports entertainment.

Valiant Capital Management: The Foundation of Hansen’s Wealth

At the core of Hansen’s financial empire is Valiant Capital Management, a hedge fund with a global reach and a significant presence in the industry. Founded in 2008, Valiant Capital has been pivotal in defining Hansen’s professional success and, by extension, his net worth.

The Strategy Behind the Success

Valiant Capital Management operates with a long/short equity strategy, a method that has proven to be lucrative over the years. With its assets under management peaking at $2.7 billion in 2012 and more recently estimated to be around $2.8 billion, it’s clear that Hansen’s strategic decisions have borne fruit.

Revenue Streams and Management Fees

Understanding the revenue model of hedge funds like Valiant Capital Management is key to appreciating Hansen’s wealth. A standard hedge fund charges a management fee, typically around 2% of the assets under management, and a performance fee, often 20% of the fund’s profits. These fees, when applied to billions in assets, result in a substantial income for the fund’s founder and principal managers.

Chris Hansen’s Personal Wealth and Investments

While his exact net worth remains private, it’s undeniable that Chris Hansen’s personal wealth exceeds $300 million. This is a conservative estimate, considering the profitability of Valiant Capital Management and Hansen’s other ventures.

Investments in Seattle’s Future

Chris Hansen has shown a profound commitment to the city of Seattle, not only through his business ventures but also through his civic engagement. He has been a key player in the Sonics Arena Investment Group, with a vested interest in bringing NBA basketball back to the city. His investment into the SoDo area—approximately $60 million into land for a new arena—speaks volumes of his dedication to revitalizing Seattle’s sports scene.

The Sonics Arena Investment Group: A Mission to Revive a Legacy

The Sonics Arena Investment Group, led by Hansen along with other prominent figures like Wally Walker, Erik Nordstrom, Pete Nordstrom, and Russell Wilson, is not merely an investment coalition; it’s a collective effort to heal the ‘civic wound’ left by the departure of the Sonics in 2008.

Public Interest and Private Investment

The group’s determination to bring back the beloved team has garnered both public interest and private investment. The proposal includes a substantial financial commitment, suggesting an infusion of half a billion dollars into building a state-of-the-art basketball/hockey arena. This initiative not only reflects Hansen’s business prowess but his deep-rooted connection to the city’s cultural and sporting fabric.

The Economics of Hedge Funds and Chris Hansen’s Earnings

To further demystify Hansen’s net worth, one must delve into the economics of hedge funds. Hansen’s Valiant Capital Management, like its peers, operates on profits generated through investments and the aforementioned management and performance fees.

Calculating the Potential Earnings

By factoring in Valiant’s annual returns and assets, one can estimate that Hansen’s earnings are indeed substantial. While the exact figures are closely guarded, the hedge fund’s performance and the scale of assets managed provide a strong indication of Hansen’s financial standing.

Challenges and Resilience in Investment Management

However, it’s important to note that hedge funds, including Valiant Capital Management, face their fair share of risks and challenges. As reported, there have been instances where the fund has experienced losses, a testament to the volatile nature of investment management. Yet, Hansen’s continued high net worth is evidence of his resilience and strategic planning.

Adaptability in a Changing Market

Hansen’s ability to navigate the complex terrain of the financial market is crucial. His adaptability in response to economic shifts ensures that his investments and, by extension, his net worth, remain robust despite occasional setbacks.

— Russell Wilson Net Worth: An In-Depth Look at His $165 Million Fortune

The Impact of Chris Hansen on Seattle

The influence of Chris Hansen on Seattle extends beyond the financial realm. His efforts towards the construction of a new arena and the revival of the Sonics are part of a larger vision to bolster the city’s economy and community spirit.

KeyArena and the Economic Ripple Effect

While Hansen’s group pushes for a new SoDo arena, there’s also the question of KeyArena’s future. The potential upgrades, costing taxpayers upwards of $100 to $150 million, are part of a larger debate on the most viable and profitable path forward for Seattle’s sports and event infrastructure.

Conclusion: Chris Hansen’s Legacy in Seattle

Chris Hansen’s net worth, while impressive, tells only a part of his story. His impact on Seattle, through his financial ingenuity and his dedication to the city’s sports legacy, showcases a man whose wealth is matched by his commitment to the community. As Seattle continues to evolve, Hansen’s name will undoubtedly be interwoven with the city’s narrative, a testament to his influence and investment in its future.

How much is Chris Hansen’s net worth?

Chris Hansen’s personal wealth is private, but it is known that he is worth more than $300 million.

What is the estimated value of Valiant Capital Management, the hedge fund founded by Chris Hansen?

Valiant Capital Management is estimated to have around $2.8 billion in assets under management.

What significant investment has Chris Hansen made in Seattle?

Chris Hansen has made a significant investment of around $60 million into land for building a new basketball/hockey arena in SoDo.

What is Chris Hansen’s involvement in bringing NBA basketball back to Seattle?

Chris Hansen is part of the Sonics Arena Investment Group, aiming to bring NBA basketball back to Seattle.

When was Valiant Capital Management, the hedge fund founded by Chris Hansen, established and what was its asset value in 2012?

Chris Hansen founded Valiant Capital Management in 2008, and the hedge fund had $2.7 billion in assets in 2012.