Unveiling the Enigma: Apple Inc.’s $3 Trillion Market Valuation! Ever wondered how a company can reach such astronomical heights in today’s tech-driven world? Join us on a captivating journey through the rise, competition, and future of Apple’s market value. From stock market performance to the role of product innovation, we’ll unravel the secrets behind this tech giant’s success. Get ready to dive into the world of big tech stocks and market dynamics, and discover how Nasdaq plays a pivotal role in Apple’s valuation. Buckle up as we uncover the fascinating story behind Apple’s market dominance and what it means for the future of tech investments. Let’s venture into the world of Celebra and demystify the captivating saga of Apple’s market valuation!

Key Takeaways:

- Apple Inc. became the first company to reach a market value of $3 trillion.

- Apple’s closest rivals in market value are Microsoft, Google parent company Alphabet, and Amazon.

- Apple’s stock price as of the provided information was $188.85.

- Apple engages in the design, manufacture, and sale of smartphones, personal computers, tablets, and wearables.

- Apple’s market value milestone was boosted by the Nasdaq’s best performance.

- Apple’s market value milestone is a result of its growth and the overall Big Tech stock wave.

Understanding Apple Inc.’s Market Valuation

The financial world witnessed a momentous event when Apple Inc., an emblem of innovation and technological prowess, surged into unparalleled territory with its market valuation. The tech giant, renowned for its sleek iPhones and robust Mac computers, clinched a record-breaking market capitalization, becoming the first company to be valued at an astounding $3 trillion. This valuation is not just a number but a testament to Apple’s enduring influence in the tech industry and its unwavering appeal to consumers and investors alike.

The Rise to a $3 Trillion Market Value

Apple’s ascent to this fiscal zenith was no happenstance but the culmination of strategic product design, manufacturing excellence, and market acumen. From its humble inception in a California garage to a colossus straddling the global tech landscape, Apple’s journey has been nothing short of extraordinary. It’s noteworthy to mention that alongside Apple’s stock price of $188.85, the landmark valuation was spurred by the Nasdaq’s sterling performance, underscoring the robustness of Big Tech stocks in the financial markets.

The Role of Product Innovation and Diversity

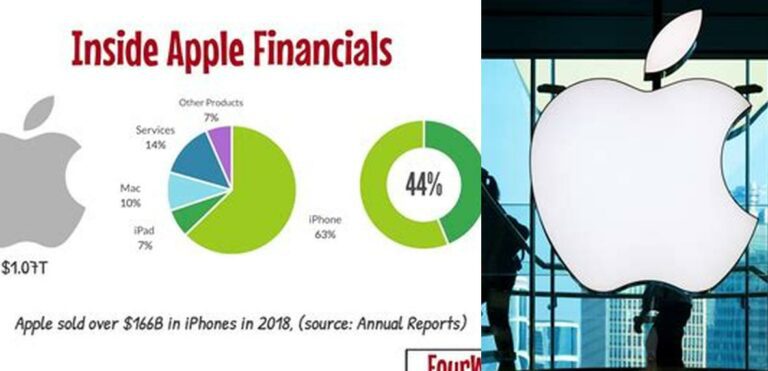

Central to Apple’s valuation is its expansive suite of products. The company has continually reinvented the wheel with its range of smartphones, personal computers, tablets, and wearables. Each product category not only serves a distinct consumer need but also complements the other, creating a seamless ecosystem that fosters brand loyalty and recurrent revenue through an array of services and accessories.

Apple’s Stock Market Performance

While Apple’s valuation is a reflection of its growth, it is also an indication of investor confidence. The stock market has responded favorably to Apple’s financial health and its ability to innovate and capture market share. The price of Apple’s stock, sitting at $188.85, is a direct consequence of this sentiment and the company’s robust financial metrics, such as its revenue growth, profit margins, and cash flow generation capabilities.

Comparison with Closest Rivals

Apple’s valuation is even more striking when juxtaposed with its closest competitors. Microsoft, with a market value of $2.53 trillion at the end of 2021, Google’s parent company Alphabet, valued at $1.92 trillion, and Amazon, at $1.69 trillion, are formidable entities in their own right. However, Apple’s leap to $3 trillion underscores its exceptional standing in the tech oligarchy. This disparity in market value also highlights the varying strategies and market positions of these tech behemoths.

Don’t Miss – Apple Net Worth Today: Unveiling the Trillion-Dollar Milestones and Global Dominance

Market Value and Competition

Despite the fierce competition, Apple has managed to stay ahead, thanks in part to its iconic brand and a loyal customer base. Its market value reflects the company’s ability to not only retain its existing users but to also attract new ones with its cutting-edge technology and user-friendly interfaces.

Financial Metrics and Valuation

Comparative financial metrics such as the Price to Earnings (P/E) ratio play a pivotal role in understanding market valuation. This ratio, which is derived by dividing a company’s stock price by its earnings per share, offers insights into investor expectations of future growth. Apple’s P/E ratio indicates the market’s optimism about its profitability and the anticipation of continued innovation and market expansion.

For you, Duff McKagan Net Worth: From Rock Star to Starbucks Investor

The Big Tech Stock Wave

The $3 trillion milestone is as much a reflection of Apple’s individual success as it is a part of the broader “Big Tech stock wave.” The collective surge of major technology companies has been a defining feature of stock markets in recent years. Investors have shown an increasing preference for technology stocks, viewing them as relatively safe bets with strong growth potential in an increasingly digital world.

Market Dynamics and Tech Investments

The market dynamics favoring tech investments have not emerged in isolation. They reflect broader economic trends, such as the digital transformation of businesses, the proliferation of cloud computing, and the integration of artificial intelligence into everyday products and services. Apple has been at the forefront of these trends, capitalizing on them to create new revenue streams and solidify its market position.

Nasdaq’s Role in Apple’s Valuation

The Nasdaq Index, known for its tech-heavy composition, has been a barometer for the tech industry’s overall health. Apple’s valuation, amplified by Nasdaq’s exceptional performance, indicates the market’s broader endorsement of technology as a critical sector for investment. The index’s rise has provided a favorable backdrop for Apple’s shares, reinforcing its market value milestone.

Conclusion and Future Outlook

Apple’s $3 trillion market valuation is not just a fleeting moment in the annals of financial history but a harbinger of the tech industry’s potential. As Apple continues to innovate and expand its product offerings, the anticipation of what lies ahead for this tech titan is palpable. The company’s valuation is a composite of its past achievements and future promise—a beacon for the tech sector and a benchmark for corporate success.

In conclusion, Apple Inc.’s worth, exemplified by its $3 trillion market value, is a multifaceted phenomenon shaped by its innovative products, strategic market positioning, and the broader tech stock wave. Investors and consumers alike will be watching keenly as Apple charts its course in an ever-evolving digital landscape, poised for new milestones and continued leadership in the tech space.

How much is Apple Inc. worth?

Apple Inc. became the first company to reach a market value of $3 trillion.

Who are Apple’s closest rivals in market value?

Apple’s closest rivals in market value are Microsoft, Google parent company Alphabet, and Amazon.

What was Apple’s stock price as of the provided information?

Apple’s stock price as of the provided information was $188.85.

What does Apple engage in?

Apple engages in the design, manufacture, and sale of smartphones, personal computers, tablets, and wearables.

What contributed to Apple’s market value milestone?

Apple’s market value milestone was boosted by the Nasdaq’s best performance and its growth in the overall Big Tech stock wave.